Blank Income Tax Form

The form can be filed by both us citizens and official resident aliens.

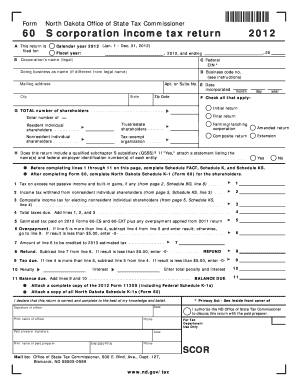

Blank income tax form. Naya saral income tax return form for resident individual hindu undivided family not having income from business or profession or capital gains or agricultural income. Income tax forms for employers. Printable 2019 federal tax forms are listed below along with their most commonly filed supporting irs schedules worksheets 2019 tax tables and instructions for easy one page access.

Form 1040 es is used by persons with income not subject to tax withholding to figure and pay estimated tax. 2019 ohio it 1040 individual income tax return this file includes the ohio it 1040 schedule a it bus schedule of credits schedule j it 40p it 40xp and it re. Form name last updated 1a.

Based on the information that you provide in your w 9 form the receiver can fill out the form 1099 and send it to the irs to share information about the possible income of the tin owner. Complete form w 4 so your employer can withhold the correct federal income tax from your pay. Individuals can select the link for their place of residence as of december 31 2019 to get the forms and information needed to file a general income tax and benefit return for 2019.

For most us individual tax payers your 2019 federal income tax forms are due on july 15 2020 for income earned january 1 2019 through december 31 2019. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Each package includes the guide the return and related schedules and the provincial information and forms.

6 april 2018 the 2017 to 2018 form and notes have been. T2201 disability tax credit certificate. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts.

Return of employee s remuneration form ir8a for the year ended 31 dec 2020 year of assessment 2021 form ir8a doc 126kb form ir8a explanatory notes pdf 100kb. Td1 forms for pay received. Estimated tax for individuals.

You may be requested to provide this form for employment and other purposes related to income. Pdf pdf fill in it 40p. Tax packages for all years.

Report under section 32 1 iia of the income tax act 1961. 5000 g 5000 g c income tax and benefit guide all provinces except non residents.